Make your money work harder and smarter.

IDeal is designed for parents who'd rather spend their college savings on tuition, instead of on taxes. It offers several significant advantages over taxable college saving vehicles:

Contribute before 12/31 each year to maximize your state tax incentive

Tax Deduction for individual filers:

Individual Idaho taxpayers qualify for a state tax deduction of up to $6,000 ($12,000 if married, filing jointly) for contributions to an IDeal account. Find out how to claim your ID state tax deduction and max out your refund.

Employer tax credit:

Idaho employers also benefit from tax incentives with a 20% state tax credit given for direct contributions to their employees’ IDeal accounts. The employer tax credit is capped at $500 per employee, per year.5

Tax-deferred earnings

Unlike most traditional investments, an IDeal account can grow tax-deferred. That means your earnings could continue to compound year after year, without suffering the bite of federal and state taxes.

The difference between tax-free growth and taxable growth can be significant, as the hypothetical chart below shows:

If you opened a 529 account with an initial investment of $25 and contributed $100 every month for 18 years, there could be almost $5,000 more for a qualified withdrawal than the same investment in a taxable account.1

Assumptions: $25 initial investment with subsequent monthly investments of $100 for a period of 18 years; annual rate of return on investment of 5% and no funds withdrawn during the time period specified; taxpayer is in the 30% federal income tax bracket for all options at the time of contributions and distribution. This hypothetical is for illustrative purposes only. It does not reflect an actual investment in any particular 529 plan or any taxes that may be payable upon distribution.

Tax-free qualified withdrawals2

You pay no federal or state income taxes on withdrawals from your IDeal account when the money is used for a qualified education expense, such as:

K-12 public, private or religious schools: Withdrawals are limited to tuition payments only up to $10,000 per year, per student.

Higher education:

- tuition

- mandatory fees

- required books, supplies, and equipment

- certain room and board expenses

- computer software and internet access

- dual credit courses and required books

Apprenticeship programs:

- fees

- books and supplies

- required equipment

Student loan repayments: Withdrawals are limited to up to $10,000 lifetime, per individual, for principal or interest on any qualified education loan of the Beneficiary or a sibling of the Beneficiary.3

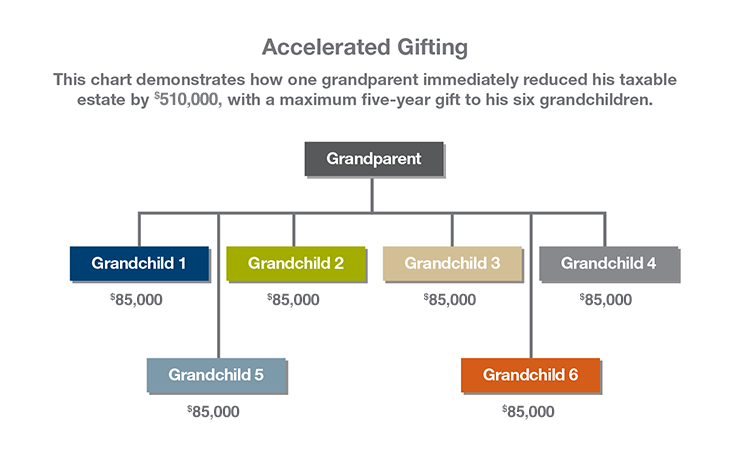

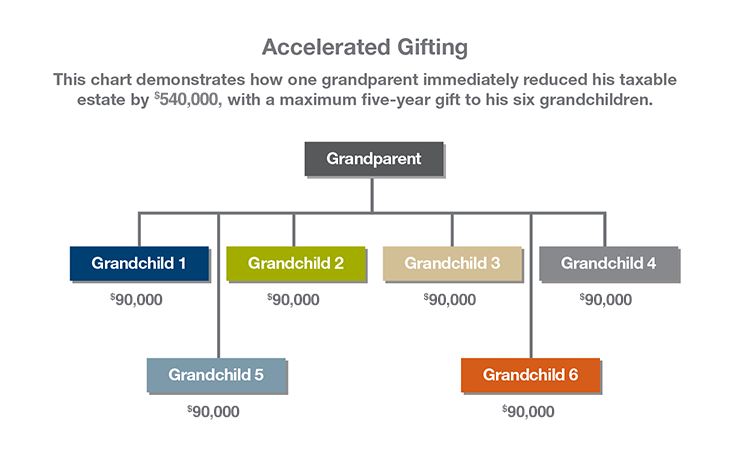

Gift and estate tax benefits

Contribute up to $19,000 ($38,000 if married, filing jointly) in a single year without incurring a gift tax. Or take advantage of "accelerated gifting" to reduce your taxable income by contributing five years' worth of gifts ($95,000 if single/$190,000 if married, filing jointly) to an IDeal account in one year without incurring gift taxes.4

Thinking about using your

tax refund to open or add

to an IDeal 529 account?

Smart. And easy. Learn more.