NEW! A SIMPLIFIED APPROACH TO INVESTING.

Introducing New Target Enrollment Portfolios

Families have different education plans, savings objectives, and time horizons. With a simplified approach to investing, saving for one or multiple education goals has never been easier.

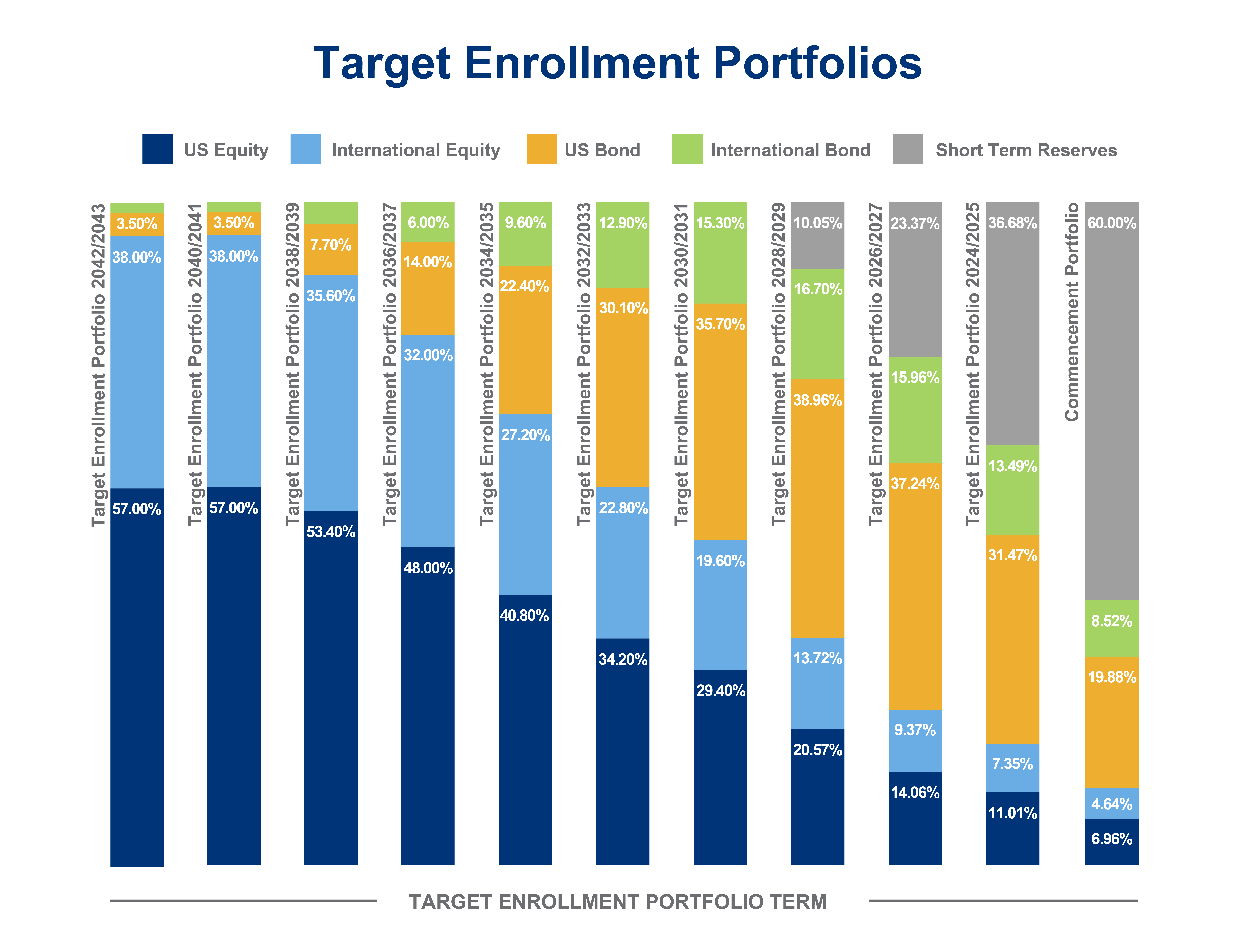

You select the portfolio and we manage the rebalancing.

Portfolios will automatically shift from a growth-oriented allocation to a more conservative mix based on the year the beneficiary is expected to enter their education program. Frequent portfolio rebalances provide small gradual shifts from equities to bonds that can help families match investments with their savings goals.

Determine your savings goal and get started.

Select a portfolio based on when your beneficiary plans to use their IDeal savings for education expenses. If you are saving for multiple education goals at the same time, select multiple Target Enrollment Portfolios within the same account for the same student.

For example, if the beneficiary plans to incur K-12 tuition expenses beginning in the year 2026, you may consider the Target Enrollment 2026/2027 Portfolio. If you also expect to enroll them in a higher education program such as 2- and 4- year, graduate, and or an apprenticeship program in the year 2034, you may also want to select the 2034/2035 Target Enrollment Portfolios within the same account for the same student. The Target Enrollment Portfolio structure allows you to select up to five portfolios where you can specify what percentage of your investments are targeted to each education goal.

Note: You could lose money by investing in a portfolio which includes the Vanguard Short-Term Reserves Account which in turn invests in the Vanguard Federal Money Market Fund. Although the money market fund in which your investment option invests (the “underlying fund”) seeks to preserve its value at $1.00 per share, the underlying fund cannot guarantee it will do so. An investment in this investment option is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The underlying fund’s sponsor has no legal obligation to provide financial support to the underlying fund, and you should not expect that the sponsor will provide financial support to the underlying fund at any time.