Important notice: IDeal – Idaho College Savings Program will be transitioning from Age-Based Portfolios to Target Enrollment Portfolios on April 22, 2022. To ensure that these changes are implemented successfully, there will be a blackout period between 2:00 p.m. MT on Thursday, April 21, 2022 and 6:00 a.m. MT on Monday, April 25, 2022. During this period no transactions or account changes can be initiated or requested.

There is no action required by you for these upcoming changes. If you have questions about these changes, email us at clientservice@idsaves.org or call us at 866.433.2533 Monday through Friday from 6 a.m. to 6 p.m. MT.

NEW! A SIMPLIFIED APPROACH TO INVESTING.

Introducing New Target Enrollment Portfolios

Families have different education plans, savings objectives, and time horizons. With a simplified approach to investing, saving for one or multiple education goals has never been easier.

You select the portfolio and we manage the rebalancing.

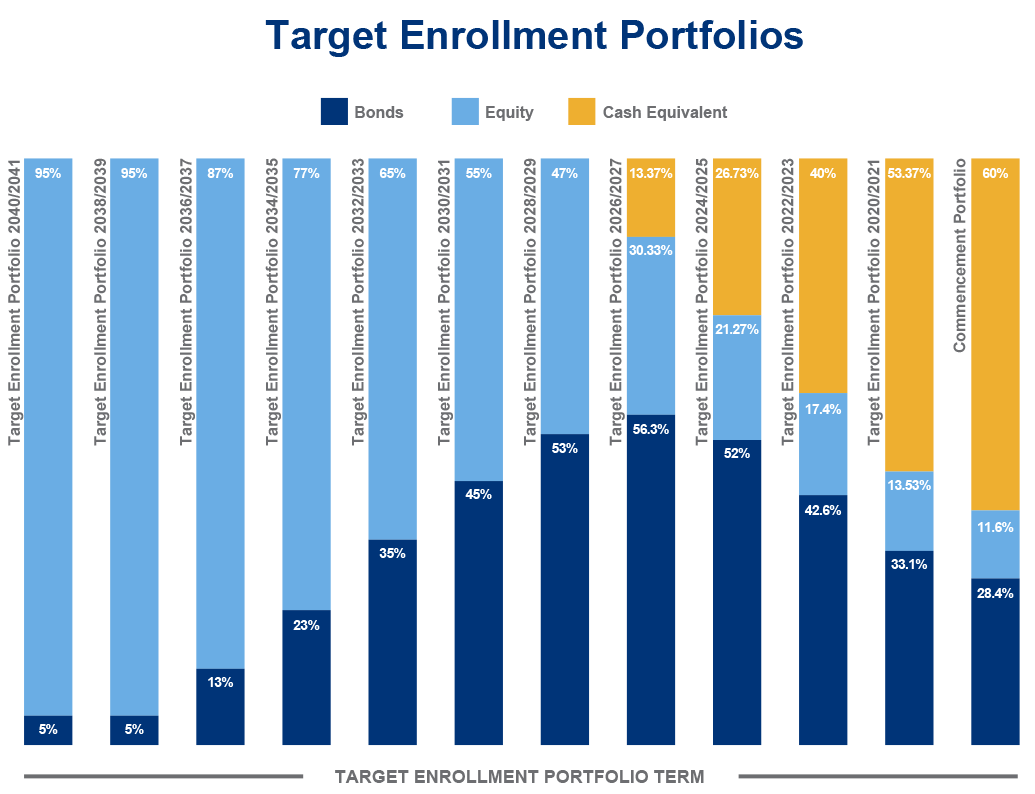

Portfolios will automatically shift from a growth-oriented allocation to a more conservative mix based on the year the beneficiary is expected to enter their education program. Frequent portfolio rebalances provide small gradual shifts from equities to bonds that can help families match investments with their savings goals.

Determine your savings goal and get started.

Select a portfolio based on when your beneficiary plans to use their IDeal savings for education expenses. If you are saving for multiple education goals at the same time, select multiple Target Enrollment Portfolios within the same account for the same student.

For example, if the beneficiary plans to incur K-12 tuition expenses beginning in the year 2026, you may consider the Target Enrollment 2026/2027 Portfolio. If you also expect to enroll them in a higher education program such as 2- and 4- year, graduate, and or an apprenticeship program in the year 2034, you may also want to select the 2034/2035 Target Enrollment Portfolios within the same account for the same student. The Target Enrollment Portfolio structure allows you to select up to five portfolios where you can specify what percentage of your investments are targeted to each education goal.

Select a portfolio based on when your beneficiary plans to use their IDeal savings for education expenses.

Replacing the Age-based Portfolios with the new Target Enrollment Portfolios

Participants who are currently investing in an Age-Based Portfolio will be automatically transitioned into the new Target Enrollment Portfolio based on the date of birth of their beneficiary. These exchanges will not be considered a taxable event and will not be counted towards the twice per year exchange limit.

If you're in the Aggressive or Moderate Track:

If you're in the Conservative Track:

These mappings were designed with the goal of providing a mix of stocks, bonds, and short-term reserves that is similar to your current asset allocations. As a result, your new Target Enrollment Portfolio may differ from your child's expected enrollment date.

After the transition is completed, all Age-Based Portfolios will be closed. If you would prefer not to be invested in the Target Enrollment Date Investment Option, you may exchange your investments out of the existing Age-Based Portfolios to a fixed asset portfolio(s) of your choosing no later than April 22, 2022 at 2:00 p.m. MT, provided you have not already made two portfolio exchanges already in this calendar year. If you wish to make additional changes once this transition has occurred, you can log in to your account and request an exchange at any time, though it will count towards the twice per year exchange limit.

Important Legal Information

By clicking on one of the social media icons, you are leaving the IDeal website, maintained by Ascensus, and are being redirected to a social media site solely maintained by the State College Savings Program Board (“Board”). Ascensus Broker Dealer Services, LLC, the program manager for IDeal, does not monitor or endorse the Board's social media activities. All IDeal social media activities are the sole responsibility of the Board.

Mr. Thiros is a registered representative of Ascensus Broker Dealer Services LLC, 877-529-2980, 95 Wells Ave, Newton MA (member FINRA/SIPC) and is not employed by the State of Idaho.

For more information about IDeal - Idaho College Savings Program ("IDeal"), call 866-433-2533 click here to obtain a Disclosure Statement. The Disclosure Statement discusses investment objectives, risks, charges, expenses, and other important information. Because investing in IDeal is an important decision for you and your family, you should read and consider the Disclosure Statement carefully before investing.

Please Note: Before you invest, consider whether your or the beneficiary’s home state offers any state tax or other state benefits such as financial aid, scholarship funds, and protection from creditors that are only available for investments in that state’s qualified tuition program. You should also consult your financial, tax, or other advisor to learn more about how state-based benefits (or any limitations) would apply to your specific circumstances. You also may wish to contact directly your home state’s 529 college savings plan(s), or any other 529 plan, to learn more about those plans’ features, benefits, and limitations. Keep in mind that state-based benefits should be one of many appropriately weighted factors to be considered when making an investment decision.

IDeal is administered by the State College Savings Program Board ("Board"). ABD, the program manager, and its affiliates, have overall responsibility for the day-to-day operations, including investment advisory, recordkeeping and administrative services, and marketing. The Vanguard Group, Inc. ("Vanguard") serves as Investment Manager for IDeal. Sallie Mae Bank serves as the Savings Portfolio Manager for IDeal. IDeal's Portfolios invest in either: (i) mutual funds and a separate account offered or managed by Vanguard; or (ii) an FDIC-insured omnibus savings account held in trust by the Board at Sallie Mae Bank. Except for the Savings Portfolio, investments in IDeal are not insured by the FDIC. Units of the Portfolios are municipal securities and the value of units will vary with market conditions.

Investment returns will vary depending upon the performance of the Portfolios you choose. Except to the extent of FDIC insurance available for the Savings Portfolio, you could lose all or a portion of your money by investing in IDeal, depending on market conditions. Account Owners assume all investment risks as well as responsibility for any federal and state tax consequences.

Not FDIC-Insured (except for the Savings Portfolio). No Bank, State or Federal Guarantee. May lose value.